Share Capital Double Entry

When company gets Application Money. Popular posts from this blog Use Three Words to Describe Your Teaching Style - May 05 2022.

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Interest on capital is an expense for the business and is added to the capital of the proprietor thereby increasing his total capital in the business.

. Would like to seek expert advice for the following scenario on how should the double entries be made correctly. On June 202X Mr. Find Out What Services a Dedicated Financial Advisor Offers.

So for example if you issued 1 million shares with a par value of 2 per share for a total of 3 million. For doing business company need big money. On 01 April the institutional investors sign the agreement to purchase all 100000 shares at 5 per share.

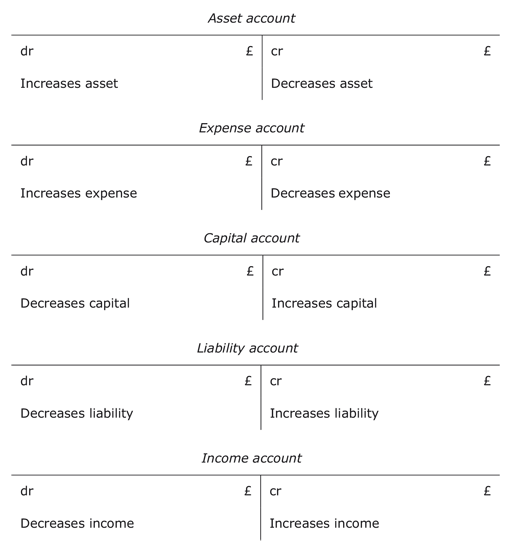

Double Entry is recorded in a manner that the Accounting Equation is always in balance. Usually reduction in capital is made under. A double entry accounting system requires a thorough understanding of debits and credits.

2 shareholders registered capital total is 210. Their definitions are noted below. I would like some help regards share capital double entry.

Capital Contribution Journal Entry Example. As per the terms of the issue of shares 15 per share was to be received in full from the applicants on 30 November 20X3. Journal entry for interest on capital is.

A debit is that portion of an accounting entry that either increases an asset or expense account or decreases a liability or equity account. Capital Introduction Double Entry Bookkeeping. However they only pay 200000 on the signing date the remaining balance will be paid later.

Dr Bank 2500000 Dr Debtor 500000 Cr Share Capital 2000000 Cr Share Premium 1000000 Hope that helps. Accounting Basics for Students. If share capital is increased in connection with the equity having decreased below the requirements stipulated in the Commercial Code the contribution is usually made for the shares above par with premium in order to meet the.

10 on which Rs. 25 million was received in cash and 05 million was still owing. Sale of shares for cash.

Par value of a share is basically a legal capital per share and it is usually printed on the face of a share certificate. I am not sure about double entry of these transactions. Both shareholders did not pay up and bank account wasnt set up yet.

It means that the company has received cash by selling its shares. How should the double entry be made to reflect correctly. I am preparing company financial statements and my clients used personal account for business purpose.

A is the only owner of company ABC which start the operation one year ago. Due to operation loss company does not have enough money to pay for a supplier so Mr. Every shareholders liability is limited up to his bought shares.

The recording of the sale of shares for cash is dependent on the par value. A total amount of 3000000 was received. It is not paid in cash or by the bank.

70 and Shareholder B. Where any paid up share capital is being refunded to share holders without reducing the liability on shares for instance a share of Rs. Assets Liabilities Capital Any increase in expense Dr will be offset by a decrease in assets Cr or increase in liability or equity Cr and vice-versa.

Please could you advise me. A credit is that portion of an. It is positioned to the left in an accounting entry.

Interest on Capital Ac. Learn More About American Funds Objective-Based Approach to Investing. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

Dr Share capital 1000k Dr Share premium 490k Cr Profit and loss 490k Cr Cash 1000k. Today we will start accounting for share capital with following transactions. A Journal Entries of Share Capital Transactions.

Accounting For Share Capital Capital Double Share wallpaper. Learn About Our Financial Advisor Services. I cheched companies house and he issued 1000 shares with 10 amount paid.

A invests an additional 50000 on 01 March 202X. Ad Savings Plans Can Be Overwhelming. 6 has been paid up is held by a shareholder Rs.

The amount received equivalent to par value is recorded. If share capital is increased by monetary contribution the companys cash and share capital are increased with a corresponding accounting entry. The minimum amount of subscription necessary for the project is 1250000.

Called up Share Capital 100000 5 200000 300000. The oversubscription of 1500000 was returned to unsuccessful applicants on 20 December 20X3. 2 out of the paid up amount is being refunded to him although the face value of the share remains unaltered.

Owners Equity Capital And Retained Earnings Double Entry Bookkeeping

![]()

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Double Entry For Share Capital

Double Entry Bookkeeping Starting A Business And Its Initial Transactions

Capital Introduction Double Entry Bookkeeping

Introduction To Bookkeeping And Accounting 3 6 The Accounting Equation And The Double Entry Rules For Income And Expenses Openlearn Open University

0 Response to "Share Capital Double Entry"

Post a Comment